Owning a small business can be a risky prospect. You’ve hinged your future financial success on a venture that’s subject to unpredictable market forces, fraudsters, and stringent regulatory measures.

Needless to say, the digital transformation brought significant improvements in efficiency and productivity to businesses. However, digitalization has, in many ways, grown your exposure to security threats and non-compliance fees. Projects are also increasingly complex, resulting in greater investment risks and potential losses.

Traditionally, unpredictability was built into the nature of running a business. Though recently, risk management software provides the foreknowledge necessary to eliminate uncertainty.

So, let’s learn how to resolve the risks in your operations.

What does risk management software do?

The risk management software market is projected to grow at a CAGR of 14.96% between 2023 and 2030 to reach a valuation of $86.53 billion dollars. This expansion aligns with the fact that 72% of risk executives report that capitalizing on digital transformation initiatives is a key component of their company’s growth. Clearly, risk management tools are being implemented across sectors, but what can they actually do?

There are various types of risk management software that aim to mitigate some of the operational challenges plaguing businesses. Different operational risk mitigation solutions are often designed for specific use cases. Although, the basic premise of these distinct tools is to reduce the financial, legal, internal, and external threats to an organization’s long-term goals.

|

There are several means to this end, so let’s go through some of the most prominent functions of risk management solutions:

- Identify and proactively mitigate risks: By centralizing operational data, the software helps you develop proactive measures to reduce the likelihood and impact of identified risks.

- Maintain regulatory compliance: Risk management tools integrate regulatory compliance frameworks and standards to catch issues before they cost you. Plus, the software can track regulatory changes to keep you up-to-date and automatically generate compliance assessments and reports.

- Conduct continuous monitoring and reporting: Risk management platforms provide real-time visibility into risk-related data, so you can track the progress of risk mitigation efforts, evaluate their effectiveness, and make informed decisions.

- Strengthen internal communication channels: Intuitive collaboration features like shared workspaces, visible task assignments, and organization-wide notifications help foster transparency among your employees and stakeholders. Potential risks can be resolved with clearer internal communication regarding mitigation strategies.

- Garner greater visibility into ongoing projects: Effective project management is one of the best ways to mitigate risks and simultaneously improve workflow issues. Project-focused risk management software provides a holistic overview of tasks and schedules so you can monitor a wide range of risks on a more granular level.

- Fortify digital security measures: The ongoing digital transformation is leaving all businesses more susceptible to cybersecurity threats. Risk identification software can pinpoint vulnerabilities, assess potential security threats, and implement risk controls to protect sensitive data and systems.

How do digital risk management solutions benefit small businesses?

A recent survey found that 52% of risk managers view proactive mitigation as equally important a factor as responding effectively. Advanced tools allow you to act quickly to resolve potential issues before they develop into losses. In fact, 86% of companies report uncovering a financial crime with the help of innovative digital technologies.

The purpose of risk management processes is to foresee and prevent potential losses. This can be done in several different ways, including by placing a greater emphasis on compliance measures, project oversight, and security infrastructure. The goal is to protect your short-term operational investments while mitigating your risk of exposure to fraudsters or fees resulting from regulatory missteps.

So, investing in risk management software ultimately turns into a positive ROI for small business owners who are able to reduce their annual losses by enabling proactive prevention rather than passive responses to problems. The reality is that the long-term health of your company is reliant on your profitability, meaning that without the modern digital infrastructure required to protect your interests, you’re left vulnerable to catastrophic losses.

Additionally, risk management software can facilitate better decision-making by providing you with accurate and timely information about potential exposure. Armed with this information, you’ll be able to allocate resources effectively, prioritize risk mitigation efforts, and make informed choices to safeguard your business from unnecessary losses.

Algorithmic risk monitoring and data analytics allow you to be on the lookout for financial crimes such as fraud, embezzlement, and money laundering all the time. You’ll be alerted to suspicious activity before you incur the potential financial loss and reputational damage of an incident.

You’ll also be notified of potential project disasters prior to an incident, which will allow you to take measures to mitigate your risks.

|

Similarly, risk management software also limits your exposure to non-compliance fees by staying on top of the complex and ever-shifting regulatory landscape for you.

Selecting the 6 best risk management tools of 2023

The reality is that operating in the modern business landscape comes with inherent risks, and digitization is exacerbating the problem. In fact, a recent survey found that 64% of North American enterprises report a risk increase over the past year.

In order to combat rising risk levels that threaten your operational viability, you need to integrate advanced digital solutions. This way, you can proactively manage your projects, finances, and compliance measures to prevent losses.

The shift to remote work prompted by the pandemic led 70% of risk and compliance experts to increase their reliance on technology. Critical functions like risk management, performance monitoring, and decision-making can now all be augmented with advanced digital tools to optimize outcomes.

So, here are the best risk management software solutions of 2023.

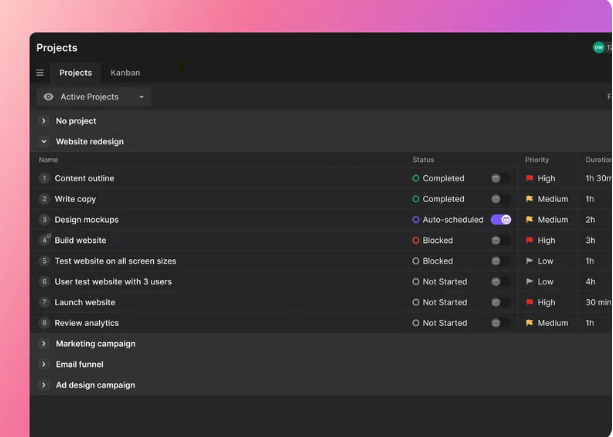

1. Motion

Motion does so much more than your average risk management software solution. Its comprehensive project management features provide greater visibility into your business operations, allowing you to ensure the smooth implementation of individual tasks.

|

Software features:

- Artificial intelligence (AI) calendar automation: Motion’s integrated AI calendar automation works as a personal assistant. It automatically rearranges your team’s calendars based on project or meeting prioritization levels and deadlines to ensure that the most important work is accounted for first.

- Meeting booker: The software allows external clients to request meetings with your staff through a link that provides the attendees’ potential availability based on their calendars. The request will include critical information regarding the meeting’s premises and will auto-populate once accepted.

- The anti-destruction system: Motion integrates advanced features to limit your employees’ time on social media, therefore mitigating your risk of potential time waste on the clock.

- Time blocking: The system allows your teams to block out time for deep focused work on critical tasks, which can help reduce errors resulting from multitasking or distractions.

- Meeting Assistant: This feature cuts down on administrative time waste by finding shared time among participants to meet.

Pros and cons:

Motion goes above and beyond most project management systems by providing greater oversight capabilities to managers and more advanced calendar integrations like AI-based tools. The software does come at a slightly higher price point, but the resulting efficiency increases brought on by the tool more than make up for the added cost.

Use cases:

Motion’s feature-rich project management capabilities make it an ideal tool for mitigating project risks.

Who it’s best for:

The software’s versatility makes it an excellent option for everyone, from enterprise organizations to individual users. Although, the team-oriented design is particularly impactful for small businesses.

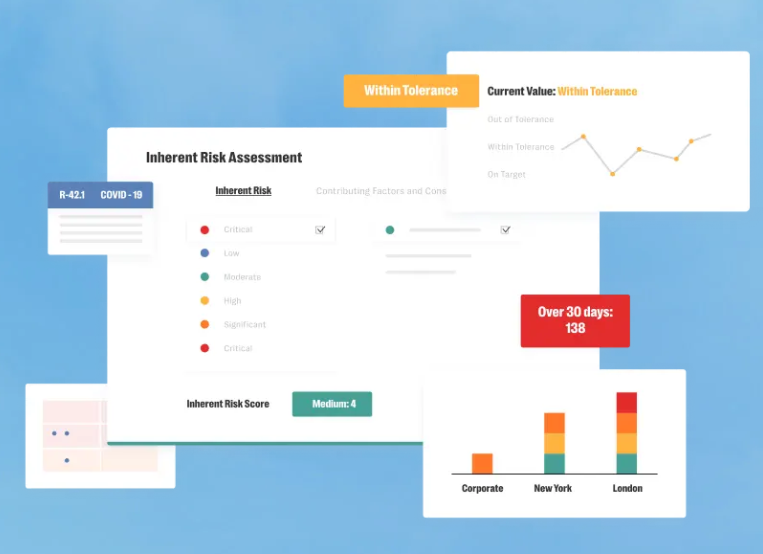

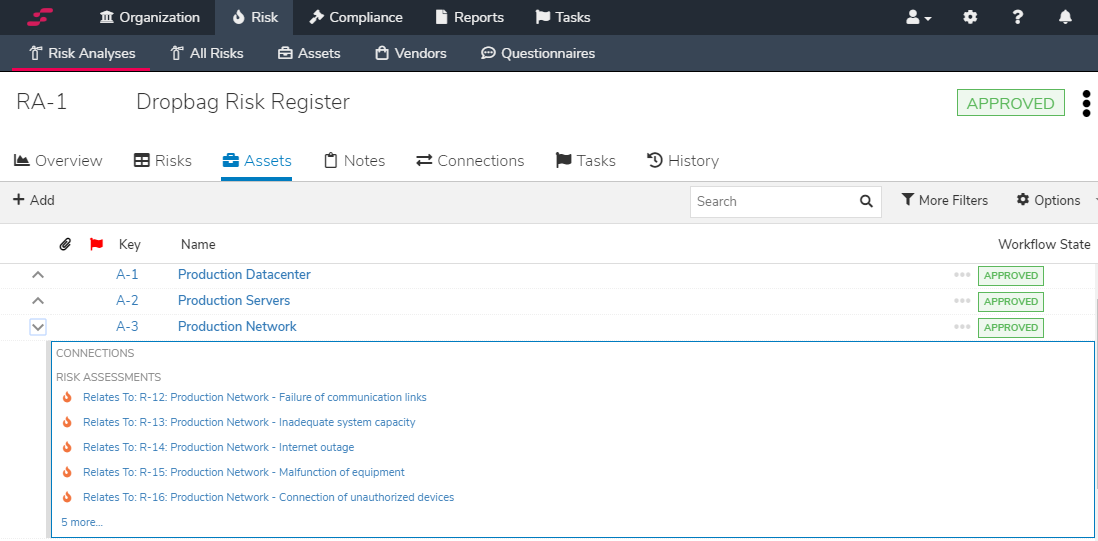

2. Resolver

Resolver is a cloud-based risk management solution that gathers and analyzes data to detail the potential business impacts of incidents. Planning and preparation are at the heart of what Resolver does, so the software cross-references regulatory requirements against your projects to mitigate risks.

|

Software features:

- Audit trails: Resolver’s risk-based audit trails alert you to potential issues and allow you to initiate mitigation strategies.

- Corrective and preventative actions: This feature aims at identifying, addressing, and preventing non-conformities, deviations, or potential problems within your organization.

- Incident reporting: Resolver works to document and report any unexpected or undesirable events, incidents, or near-misses that may occur.

Pros and cons:

The ease with which you can create reports with Resolver is one of its key benefits. However, users have also reported issues with file transfers and system snags resulting from frequent updates.

Use cases:

Resolver is best used to identify key risks in project futures by analyzing both your business objectives and the regulations you’re subject to. It’s ideal for managing audit processes.

Who it’s best for:

Resolver is best for businesses operating in tightly regulated industries such as healthcare, financial sectors, or manufacturing.

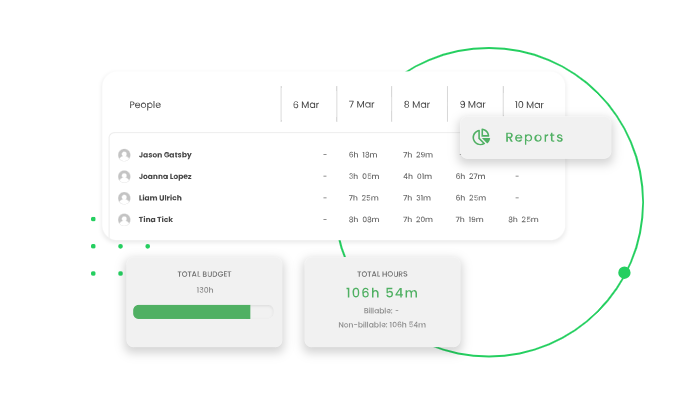

3. TimeCamp

TimeCamp tracks your team’s time working, productivity, project profitability, and performance. It helps you maximize the value you extract from working hours. Its main focus is to mitigate your exposure to labor investment risks.

Software features:

- Budget tracking: Simple reports make it easy for your team to track project expenses.

- Timesheet approval: You can approve timesheets with one click, which reduces the amount of labor required for more rigorous expense risk management.

- Productivity tracking: TimeCamp allows you to track your team’s output to ensure you’re getting the most out of your employees.

Pros and cons:

TimeCamp makes it easy to track and prevent expense issues. Although, users report that the system can be slow at times and that the mobile app could use additional upgrades.

Use cases:

TimeCamp can be used to prevent overpayments or timecard fraud by tracking worker progress.

Who it’s best for:

TimeCamp is ideal for companies that have a dispersed organizational structure or work with third-party contractors.

4. StandardFusion

StandardFusion is an integrated risk management GRC solution. It's capable of performing audit management, compliance oversight, and third-party assessments. And it also includes end-to-end capabilities that make it a comprehensive risk management software solution.

|

Software features:

- Risk dashboard: Key metrics are laid out in the easy-to-navigate risk dashboard.

- Risk management: Users can easily see the likelihood or consequences of potential risks.

- Training sessions: StandardFusion offers users support in the form of training sessions and technical assistance.

Pros and cons:

StandardFusion offers superior navigability through its intuitive user interface. Yet a lack of customizability may limit advanced risk reporting.

Use cases:

StandardFusion is an excellent tool to empower your information security team.

Who it’s best for:

While the platform has a broad range of potential uses, organizations concerned with maintaining the confidentiality, integrity, and availability of their data will find StandardFusion particularly useful.

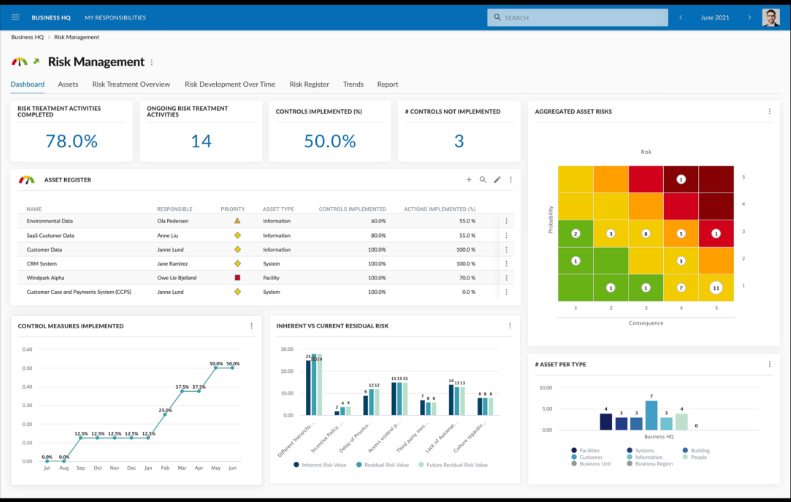

5. Corporater

Corporater is a governance, performance, risk, and compliance (GPRC) platform that allows you to predict and mitigate project risks with robust reporting capabilities. It can be used to track and analyze risks across entire organizational functions.

|

Software features:

- Opportunity and consequence heat maps: Corporater offers uniquely impactful visual representations of risk factors.

- Risk dashboards: The system dashboard makes critical information available at-a-glance.

- Report generation: Corporater allows users to create reports through their software.

Pros and cons:

While Corporater’s extensive range of key features and reporting capabilities make it a comprehensive solution, it also comes with a sharp learning curve due to its complexity.

Use cases:

Corporater enables organizations to effectively manage their strategic objectives, KPIs, and initiatives more effectively.

Who it’s best for:

Corporater is ideal for a wide range of organizations and industries, although it’s particularly suitable for enterprises or multi-national corporations.

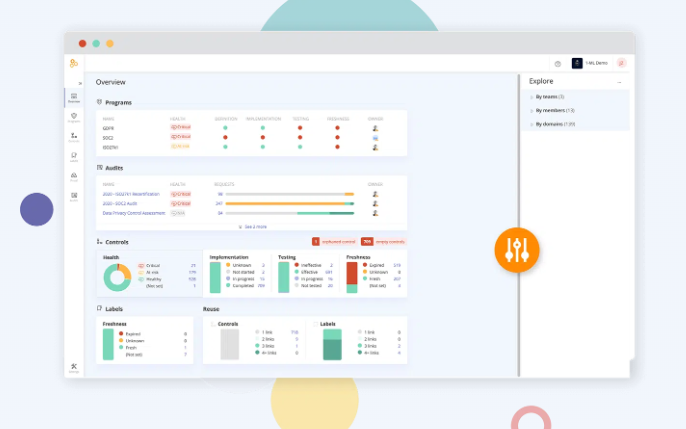

6. Hyperproof

Hyperproof is a feature-rich solution with the capacity to track, analyze, and reduce risks based on their potential impacts. It’s a comprehensive solution that covers a wide range of risk mitigation strategies.

|

Software features:

- Compliance management: Hyperproof provides advanced tools to track and manage regulatory requirements.

- Document management: Users can store, organize, and access compliance-related documents, policies, procedures, and evidence.

- Reporting and analytics: Hyperproof allows you to generate customizable reports, visualize data through charts and graphs, and gain insights into compliance trends.

Pros and cons:

With a flexible risk assessment framework Hyperproof allows you to tailor your risk management strategies to meet your exact needs. However, some users have reported lagging load times.

Use cases:

Hyperproof helps organizations manage regulatory compliance, risk management, vendor management, audits, policy and procedure management, data privacy, security, and certification programs.

Who it’s best for:

Hyperproof is particularly beneficial for companies that face complex compliance needs, handle sensitive data, and require centralized tracking tools.

Mitigate risks with the right digital tool

To compete in today’s marketplace, you need to make use of digital tools. However, the digital world can be a risky place. Financial fraudsters, strict regulatory monitoring, and, most immediately, the potential risks associated with project issues could spell disaster for your business.

So, you need a strong risk management tool that can combat the chaotic nature of hyper-efficient workflows. Your project managers need greater visibility and insight into your operations to prevent project disasters, which is why you should consider our top pick for 2023: Motion.

Motion tracks, schedules, and optimizes projects from their inception through their conclusion, making it easy for project managers to mitigate risks. Features like AI integrations set the software apart from anything else on the market, which is why it’s rapidly becoming the first choice of small business owners.

Reach out to learn more about your free trial of Motion’s risk management solution.