Business interruption, cyber incidents, inflation, and energy crisis. These are just the top four of a long list of risks business owners face in 2023. In fact, the Allianz Risk Barometer report has shown that the risk of cyber incidents and business interruption has grown by 34% since 2022. As the global economy slows and inflation adds increasing pressure, risk management is critical for business owners.

But how to get started? As a business owner, you know you’re shouldering some risk. But how much? And how can you create plans to manage this risk?

In this article, we’ll look at what risk management planning is and why it could be the most important thing you do for your business this year.

What is risk management?

Risk management identifies and deals with potential risks that might affect a business or organization. It involves several steps to ensure that if a threat becomes a reality, it doesn’t cause too much harm to your business.

Risk management involves:

1. Risk identification:

Risk identification aims to determine what could go wrong and cause problems in your business. Create a risk register by looking at things inside and outside your business that might pose a risk, such as energy costs, inflation, or uncertain events caused by the weather (and the possible severity of these events).

2. Risk assessment:

At this stage, you'll conduct your risk assessment. You'll do this by considering how likely those risks are to happen and how much damage they could do. The goal is to decide which risks are most important to deal with first based on how likely they are to happen and the damage they could do to your business.

3. Risk mitigation plans:

In the risk mitigation stage, you'll devise actions to lessen or avoid these risks. By putting contingency plans in place, you'll know how to protect your organization should the risk occur (and be prepared to ensure the risks don't cause too much harm).

4. Continuous monitoring and review:

Risk monitoring and review help you track the risks and check if the plans to deal with them work. If needed, you'll change your actions (or plans) based on what you find in your review.

5. Continual improvement:

The key here is learning from experience and improving the risk management process. As you become familiar with this process, you'll get better at dealing with new risks that might come up in the future.

What is a risk management plan?

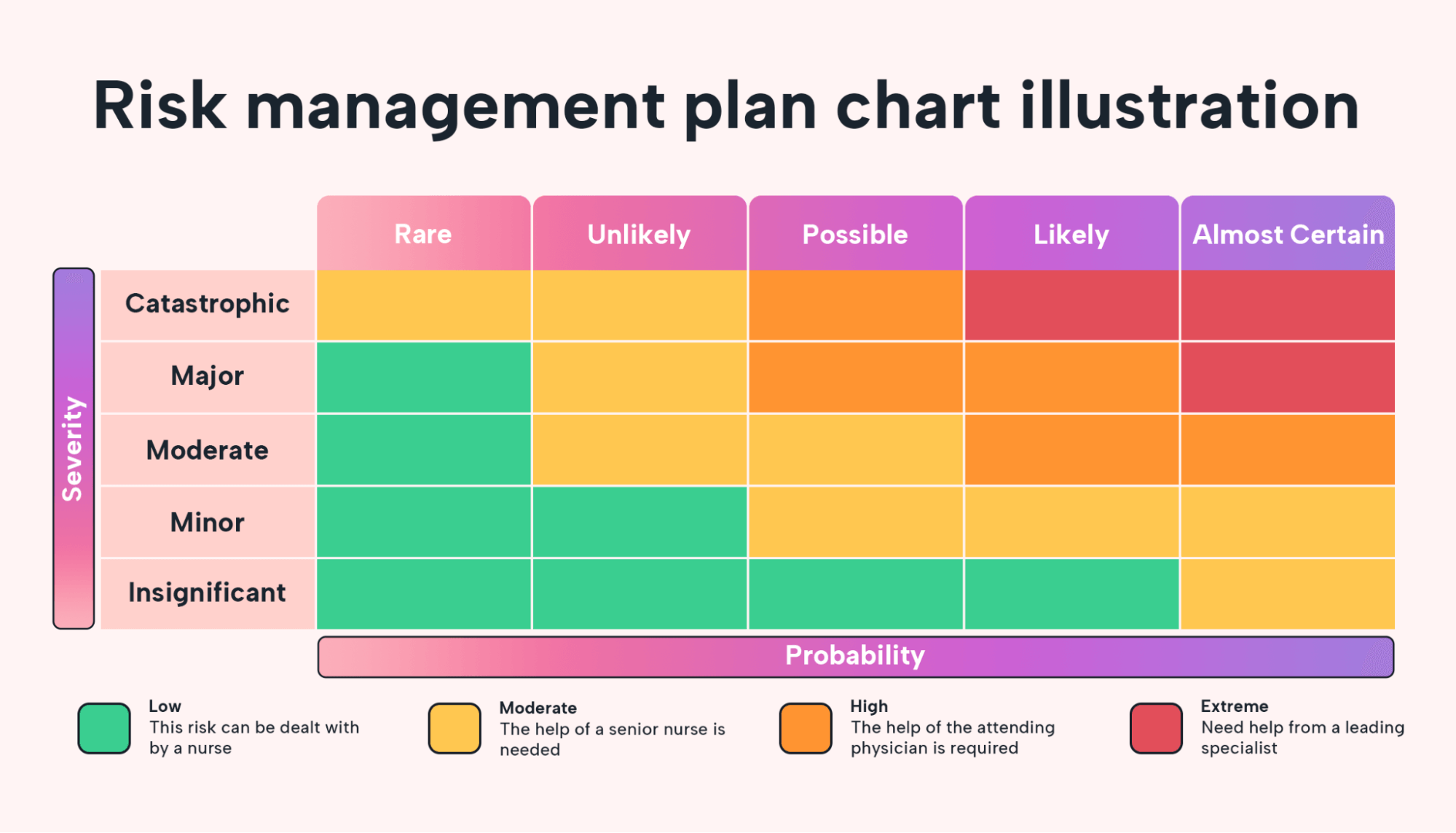

Risk management is the act of considering risks to your business in advance and creating contingency plans to manage these risks should they happen. A risk management plan is a document that contains these risk assessments and risk response plans. Risk management plans are often done as a risk assessment matrix which ranks risks by two criteria: Potential impacts and likelihood.

Impact: This tells you how bad a risk could be for your business if it happens. It helps you understand the potential damage or harm the risk could cause. Is the potential impact minimal? Or catastrophic? Gaging the impact enables you to focus your efforts on high negative impacts.

Likelihood: This is an estimate of the probability of a risk happening.

When doing your risk management planning, you'll use this risk matrix to create contingency plans based on the level of risk in the order of the likelihood of the risk happening.

Together, these criteria determine the appropriate level of attention and response needed for potential risks to your business.

|

Why is a risk management plan important?

Your risk management plan is crucial because, let’s face it, life is full of surprises. It’s like having an umbrella on a rainy day or wearing a seatbelt while driving.

As a business owner, you bear the responsibility of risk. Planning allows you to be prepared in advance while you’re calm and in “solution mode” rather than under pressure at the moment something happens. Having a plan means you’ve already considered all possibilities, and even if you’re under stress, you can implement each step one at a time.

A risk management plan helps you safeguard against the unexpected, allowing you to protect your assets, reputation, and bottom line.

Benefits of a risk management plan

There are many benefits to having a risk management plan for your business. These include:

Protection and preparation

A risk management plan helps keep your business safe and ready for unexpected risk events. By looking at potential risks ahead of time, the plan lets you take proactive steps to reduce harm and be (better) prepared.

Smart decision-making

With a risk management plan, your decisions will be faster and easier if and when the time comes. Trying to decide what to do during a crisis can be tough (and stressful). Having a step-by-step plan under pressure allows you to allocate the necessary resources to the problem while continuing business as usual.

Keeping things going

A risk management plan helps keep your business going during tough times. When you're prepared with backup plans, you'll minimize disruptions to your business.

Compliance and regulation

Some industries, such as manufacturing, require a risk management plan as part of your compliance. Having a plan will help you avoid penalties and legal problems.

How do you identify risks?

Start by thinking about things that could go wrong in your business. This might not be fun, but it's critical.

Brainstorming

What's happened in your business in the past that you can learn from? What went wrong in your projects? Are there ongoing project risks that you should account for? Think about the external threats that we've covered. How could these impact your business or future projects?

Talk to your project team, project stakeholders, suppliers, and customers for their perspectives. Look at incidents or problems that have happened to competitors or similar businesses.

SWOT analysis

SWOT stands for strengths, weaknesses, opportunities, and threats. In this step, you'll examine those for your business, including employees, suppliers, and competitors.

Some questions you might ask yourself are:

- What are your business' strengths?

- What are your weaknesses?

- What opportunities aren't you taking advantage of right now?

- How can you beat your competitors to those opportunities?

- What threats exist in your industry? Conduct risk analysis on other businesses in your industry. For example, consider how Uber threatens taxi companies and streaming threatens the movie industry. What technologies exist in other sectors that could impact yours?

Checklists and templates

Consider using risk identification tools like a risk checklist or risk assessment templates to help you think through different areas of your business and uncover potential risks.

Look at all the different areas of your business: finance, sales, marketing, customer experience, and operations.

Industry research

Keep an eye on your industry for risks. Stay informed about recent news related to your industry by following industry websites and blogs. Subscribe to relevant newsletters to keep you up to date.

How do you analyze risks and assess their impact?

Now that you know which risks you need to plan for, it's time to analyze their impact and the likelihood they'll occur so you can create your risk assessment matrix.

As part of the analysis, you might want to look at past incidents and industry trends. You might also consult a 3rd party like a lawyer, accountant, or business consultant to get a deeper understanding.

For example, if a client were to sue you, what would be the financial impact factoring in the time spent on the lawsuit (and your lawyer). Can your business continue to run? Would your assets be at risk? These are all key questions when assessing the impact of risks. And you'll want to consider both long-term and short-term effects.

This is a challenging exercise, but one that could save you thousands of dollars (and lots of headaches) in the long run. When you clearly understand what risks your business faces, you can get your response strategies in order up front.

How do you plan response strategies?

A good contingency plan contains six stages:

- Risk assessment: What are the risks you want to plan for? What impact will they have? A business impact analysis can be a helpful tool at this stage.

- Trigger events: How will you recognize when the risks are occurring?

- Roles and responsibilities: What steps will you take, who'll take them, and when?

- Communication plan: Who will you communicate with, how, and when?

- Contingency plan testing: Dry-run your plans to make sure they work when the time comes.

- Plan review and updates: Continuous improvement is critical. Don't set and forget. Review and update your plans regularly.

|

What are the biggest risks small businesses face in 2023?

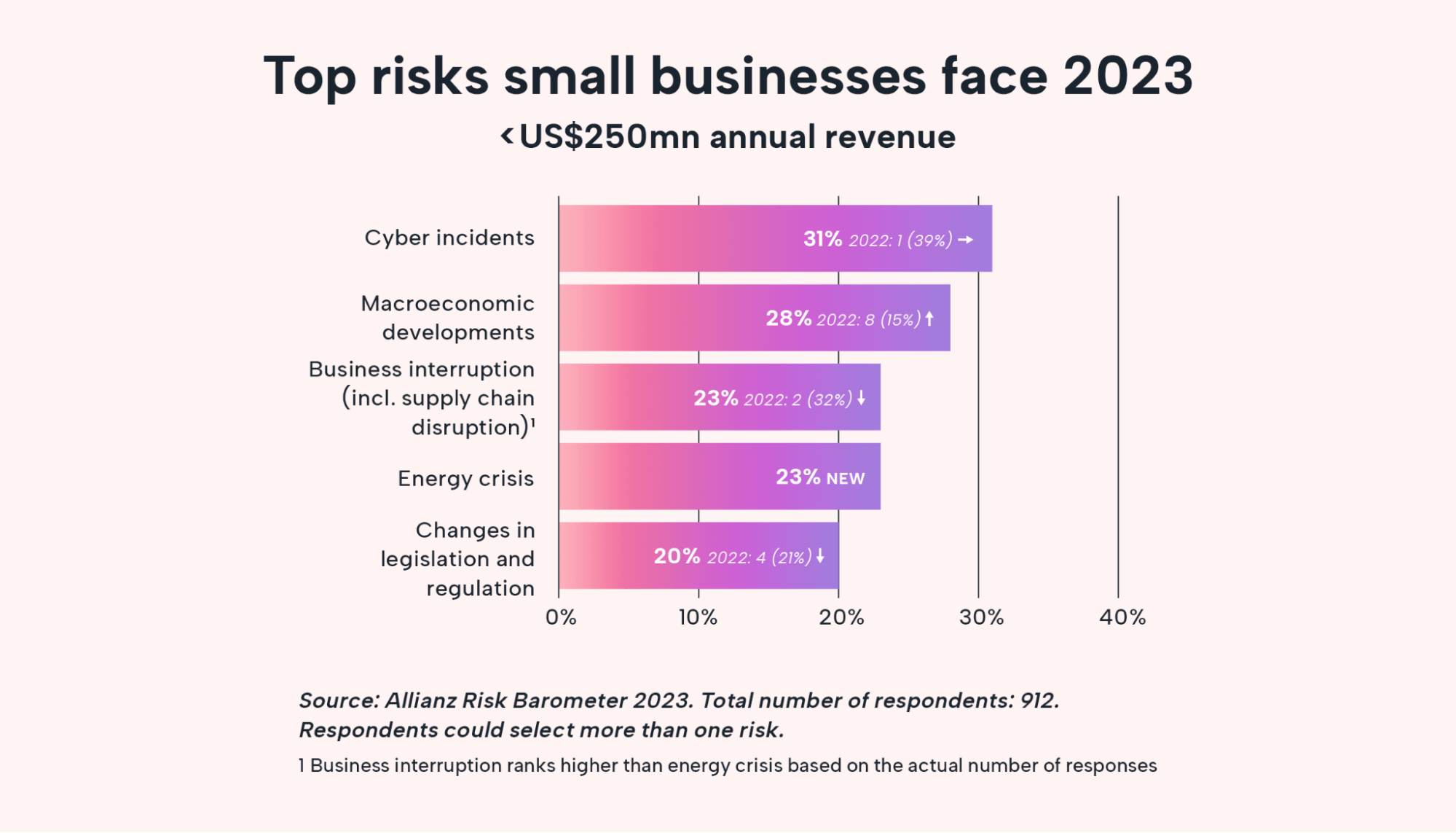

Risk isn't just the possibility of someone suing you or an employee accident. In fact, according to that 2023 Allianz Risk Barometer, small businesses across 94 countries list the following risks as the top threats their businesses face:

Cyber incidents

A cyber incident is when something goes wrong in the digital world that affects your small business. It could be a problem like hackers getting into your computer systems, stealing important data, or your website malfunctioning.

The 2023 Allianz Risk Barometer found that 45% of respondents listed cyber incidents as their number one most feared business interruption. The report highlights that “if a small company with poor controls or inadequate risk management processes suffers a significant cyber incident, the reality is there is a chance it might not survive in the long run.” When completing your risk assessment plan, consider how cyber incidents could impact your business. Where are your online vulnerabilities?

Energy crises

In second place, the Allianz Risk Barometer ranks energy crises, with 45% of business owners fearing its impact.

Inflation is significantly impacting energy bills globally. Australia, for example, is seeing energy bills increase by as much as 40-60% in some states. How would your business cope with energy costs twice or three times higher than you currently pay?

Macroeconomic developments like inflation and recession

Allianz reports that “the US, China, and Europe – are in crisis at the same time, albeit for different reasons,” contributing to economic instability, inflation, and recession. Global insolvencies are expected to rise by 19%, according to Allianz Trade.

How have businesses like yours survived similar economic conditions in the past? How can you factor in price increases and lower customer spending into your risk assessment?

Business interruption (including supply chain interruptions)

Whether a manufacturing business or an online marketing agency, you rely on other companies to supply or purchase your goods and services. As we saw during the pandemic, when there are delays in shipping and transportation, you take the hit.

|

Your business may be going strong, but how would your ability to continue work be impacted if, for example, your freelancers could no longer afford to remain self-employed? Or if your ads agency went out of business? Consider your supply chain and what risks it faces. Then consider how their inability to continue to work with you would impact your business.

What’s next for your risk management planning?

A risk management plan is an important tool for protecting your business and being ready for whatever comes your way.

If the past few years have taught us anything, it’s to be prepared for the unexpected. A risk management plan keeps your business safe. It helps with decision-making so you can use resources wisely. It helps keep your business going during tough times and builds trust with your customers and suppliers.

Simplify your risk planning tasks using Motion project management software. You can use the software to delegate your contingency tasks, auto-schedule recovery and planning meetings, and centralize your contingency planning for easy implementation. Try Motion Free Today.